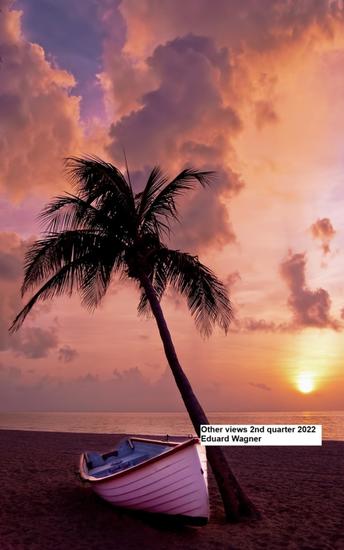

Other views 2nd quarter 2022

Eduard Wagner

Editora: BookRix

Sinopse

Since we are in a time of upheaval, events keep occurring that give us something to think about. I try to see some of these tendencies from a different perspective. I will of course leave it up to you whether this also applies to your views, without wanting to influence them.